THFC price first bond in four years

2017-07-28

After a gap of almost four years, THFC has today priced a £186m tap of its THFC Funding 3 Bond transaction (first issued in October 2011). At £625m outstanding this was already the largest Housing Association Bond in the market.

The tap priced at Gilts plus 1.20% resulted in an effective rate of 3.07% for the 26 year transaction.

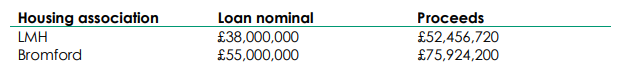

£93M of the transaction have been allocated to Liverpool Mutual Homes (LMH) and Bromford Housing Group on day one.

A further £93m of the bonds issued have been retained by THFC to fulfil a steady pipeline of demand building up through the rest of the year.

The transaction follows a flurry of capital markets activity in recent days with a £500m transaction from L&Q and a £50m retained bond sale by Walsall Housing Group.

Piers Williamson, Chief Executive of THFC said “this deal marks a welcome return for us to writing core business. The AHF programme (issuing Government Guaranteed debt) has been our preoccupation for the last four years, but it could not fulfil some funding needs, such as refinancing. Coming back to the THFC bond programme has allowed us to maximise some features to mitigate perceived inflexibilities like cost of carry and security efficiency”.

Williamson also highlighted perceived changes in the finance market since THFC last issued: “We estimate HA refinance needs have doubled in the last couple of years to a global total of circa £2Bn per annum. Associations are more actively trying to protect legacy bank credit agreements and at the same time create new flexibilities, ultimately permitting them to deliver more badly needed affordable homes.

The potential cost of changes in building and fire regulations following the Grenfell tragedy and current merger activity were also the subject of active debate with investors. Despite this, the THFC bond proved popular, eliciting demand for over 2 ½ times the bonds actually issued.

LMH’s Executive Director of Resources, Peter Fieldsend, has said: “This bond issue is a key element in LMH’s ambitious Growth Business Plan and will ensure sufficient resources are available to support our medium and longer-term business targets. The plan initially focuses on developing 2,500 new-build homes across the Liverpool City Region over the next four years”.

While Lee Gibson, Financial Director at Bromford Housing Group added: “THFC today secured £75m of bond funding for Bromford. We are very pleased with the service that we received from THFC and the rate secured. Bromford will be using the £75m to develop new homes, which is part of the programme to deliver 5,311 homes

over the next 5 years “.

The proceeds reflect the difference between the nominal interest rate on the bond/loan at 5.20% and the effective rate at 3.074%.

If you require any further information, please contact:

Piers Williamson, The Housing Finance Corporation Limited

Tel: +44 (0)20 7337 9920, Email: Piers.Williamson@thfcorp.com

Lee Gibson, Bromford Housing Group

Tel: 01902 396830, Email: Lee.Gibson@bromford.co.uk

Peter Fieldsend, Liverpool Mutual Homes

Tel: 0151 235 2422, Email: Peter.Fieldsend@liverpoolmh.co.uk

Related Articles

News

THFC Bond Issue reaches £1Bn milestone

Today, THFC Funding no. 3 passed the important £1bn threshold of issuance with its 8th tap issue, five years after.

2019-01-18

News

bLEND prices £250m benchmark first deal

bLEND Funding, the new capital markets aggregator set up by The Housing Finance Corporation (THFC), has quickly followed up the.

2018-09-14