bLEND prices £250m benchmark first deal

2018-09-14

bLEND Funding, the new capital markets aggregator set up by The Housing Finance Corporation (THFC), has quickly followed up the launch of its £2bn MTN programme last month with an inaugural £250m bond.

The 29-year transaction, involving three underlying Housing Association (HA) borrowers, achieved two and a half times oversubscription and priced at Gilts + 1.58% and a re-offer cost of 3.45%. This was marginally more expensive than the rate achieved for the recent £350m Peabody transaction which priced at a credit spread of Gilts +1.55%.

Piers Williamson, CEO of THFC, bLEND’s parent said “while demand for the deal was strong, in the lead up to BREXIT, institutional investors have seen a concentration of HA issues and, perhaps unsurprisingly, a dearth of alternatives such as property or infrastructure deals – as investment decisions are deferred”. He explained that this leads to a concentration of HA deals in investment indices and, ahead of next March, investors can demand a higher price for their investment.

Explaining the business model, Williamson said that bLEND had been 18 months in development. “We called it bLEND to emphasise to borrowers and investors that it was a new model, with terms much closer to own-name bond issues than THFC”. He added: “We have used Moody’s public-sector pool financings methodology to arrive at a group rating for bLEND. Borrowers do not need a public rating to take part in bLEND, but they do need to undergo a private rating assessment process. bLEND’s group rating then reflects the weighted average of all the participants”.

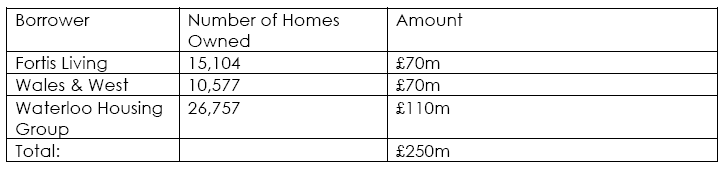

At inception, bLEND achieved an A2 Moody’s rating. “This puts bLEND in the top quartile of Moody’s ratings for RPs”, according to Williamson. The initial borrowers are:

The Moody’s rating is currently under review, awaiting the outcome of merger discussions between Fortis and Waterloo which will be finalised later this year.

As an MTN programme, bLEND has the flexibility to issue different maturity bonds to appeal to both borrowers and investors. “There has been a lot of debate recently about varying the maturity of borrowing to pull in new investors”, said Williamson. “Even though rates are increasing, the continued ability to access long term funding at the level we have achieved (3.45%) looks sensible in funding a social housing business. We are by far the most frequent issuer of HA related deals in the market and talk to many different funds. Our experience is that new investors either demand higher returns or do not have a material amount of funding to put to work”.

bLEND’s business model indicates selective growth of circa £250m a year for four years. A term of its MTN programme is that the addition of a borrower cannot adversely impact the (then) rating of the outstanding bonds.

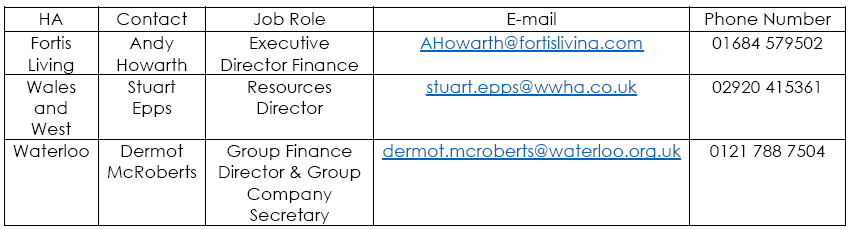

If you require any further information from bLEND, please contact:

Piers Williamson, Chief Executive: piers.williamson@thfcorp.com

Charlie Heywood, Marketing Analyst: charles.heywood@thfcorp.com

Related Articles

News

EIB in talks to provide £500m under Affordable Guarantee Scheme

Following the Government’s announcement last week of Guarantees of up to £3.5Bn to support the delivery of up to 30,000.

2013-06-24

News

THFC appoints new finance director

The Housing Finance Corporation Limited (THFC) is pleased to announce the appointment of Julie Laraine Coetzee as Finance Director and.

2023-04-06