THFC brings record breaking tap to market

2013-10-08

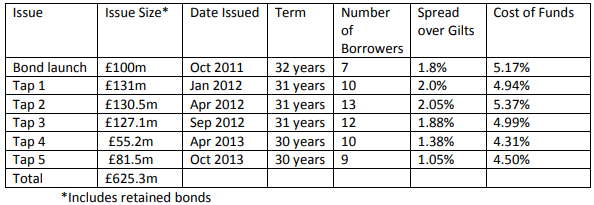

THFC further increased the size of the largest Social Housing Bond in the Sterling market today. The £81.5m tap issue priced at 4.50% and brings the total outstanding on THFC Funding 3 to £625m THFC also took the opportunity to sell a further £3.5m of previously retained bonds.

Demand from investors was intense with the bond initially between three and four times oversubscribed. This reflects lack of recent supply of Housing Association bonds and THFC’s reputation amongst investors. Off the back of a recent review which saw THFC’s credit rating once more endorsed at A+ Stable – for the 9th year in a row by S&P, THFC road-showed 18 investors. THFC’s stable rating contrasts with the recent double downgrade of rival debt aggregator GB Social Housing and general lowering of sector ratings by Moodys.

“This deal is a great example of us returning to our roots” said Piers Williamson, Chief Executive of THFC. “We are delivering a cost of borrowing to rival the biggest HAs to community based HAs who themselves are stepping up to the plate and doing their part in developing their neighbourhoods”.

The deal had 9 underlying borrowers, predominantly English, but including Fold HA from Northern Ireland. £3.5m of retained bonds were issued for an existing Welsh client, United Welsh HA.

When asked about the relative popularity of private placements this year, Williamson commented “THFC prides itself on delivering a lower cost with speed and certainty of execution. We didn’t need to include the typical investors in Private Placements in the group allocated bonds, because their bids were not fully competitive”. From start to finish it is understood that this transaction took five weeks to put together.

The borrowing group were:

THFC Funding 3: How the Issue grew to be the largest HA Bond

Contacts

Related Articles

News

AHF delivers a series of transactions at tight spreads

This week has seen a series of three transactions for the Government guaranteed aggregator, Affordable Housing Finance (AHF). Each has.

2017-10-17

News

THFC retains ‘A’ long-term credit rating with stable outlook despite challenging conditions

THFC, the UK’s leading affordable housing aggregator, has had its ‘A’ long-term rating affirmed, along with a stable outlook from.

2023-09-28