THFC Bond deal breaks 5% Cost barrier!

2012-01-18

At a time when bank pricing is once again increasing for housing associations, THFC took advantage of continued low Gilt yields to issue a £131m follow on (tap) issue of its 32 year THFC Funding (3) deal. The deal was lead managed by Royal Bank of Canada and Royal Bank of Scotland and was for ten underlying borrowers. The yield on the deal was 4.94%.

The 5% barrier is an important psychological barrier on long term deals for investors and borrowers alike. “Since 2006 out of £3.6bn of HA public bond issuance, only £180m has priced below 5% – and we had been responsible for £69m of that” said Piers Williamson, Chief Executive of THFC. THFC had to pay a credit spread on the deal of 2%, the highest it has paid in recent years. Williamson said “Sterling investors are no fools, they know that housing associations are increasingly looking to the capital markets as banks are no longer prepared to do long term deals. This reflects the new reality for Associations. They can still do funding deals that most banks and many sovereign nations can only dream of”.

There is more HA issuance waiting in the wings, with public ratings announced for Radian, Hastoe and Midland Heart and with a significant number of larger HAs waiting in the wings to issue.

Another question in the market at the moment is whether the Bank of England will extend its Quantitative Easing (so called QE2) programme beyond the end of February. The programme is helping keep long term borrowing rates at levels last seen in Victorian Britain. The most recent sharp fall in annual Consumer Price Inflation, targeted by the Banks Monetary Policy Committee (MPC) combined with fears of a double dip recession, suggest that QE may be extended beyond February. This would help keep the cost of issuance down for HAs considering entering the capital markets later in the year.

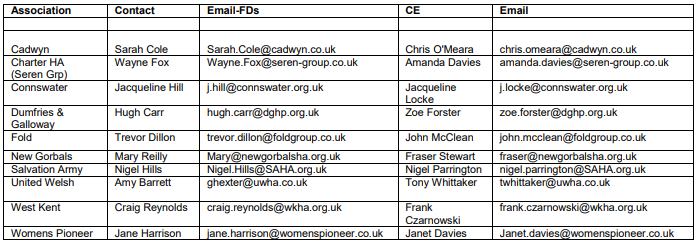

THFC’s bond had a strong regional showing with two Scottish, three Welsh and two Northern Irish Borrowers. The largest participant (£40m) was Dumfries and Galloway HA, the largest Scottish Association outside Glasgow.

Related Articles

News

THFC computers donated to Malawi schools

It is with great pleasure that THFC has donated PCs, servers and networking equipment to The Turing Trust. The donated.

2019-12-02

News

THFC backs modular housing

The Housing Finance Corporation’s board has backed the acceptance of volumetric and panelised modular housing as security for its lending.

2020-09-02