THFC beats bond market volatility

2018-12-06

THFC executed a £16m retained bond sale for Adactus Housing this morning, taking advantage of a significant short-term fall in gilt yields to deliver an all-in cost under the psychological 3.5% level.

This latest deal, which priced with a gilt of 1.826% giving an all-in of 3.476%, will help both the association and the group, to provide much-needed affordable housing and community care for its residents.

The issuance was for Adactus Housing Association, part of the Jigsaw Homes Group, who own and manage over 13,000 properties across the North West of England.

The Executive Director of Finance at Adactus, Paul Chisnell, has said, ‘Really pleased with the 3.476% all in rate locked in for 25 years, a great result with the market as volatile as it is. This rate reduces Jigsaw Homes’ average cost of borrowing and the finance underpins our development plans of delivering c600 new homes per annum over the next four years.’

Today’s deal signifies THFC’s continued ability to provide consistently and competitively priced bond finance, especially at a time where similar funding institutions seem to be struggling with pre-BREXIT instability.

Almost £1bn of issuance has now taken place under the THFC Funding No.3 programme.

Piers Williamson, Chief Executive of THFC, has stated, ‘The gilt market has become very volatile from day to day recently, reflecting both BREXIT uncertainty, but also concerns from the US that their economy may be weakening. Our approach to retained bonds, coupled with our track record, puts us in pole position to take advantage of narrow windows of opportunity and deliver cost-effective funding to our borrowers – even in these market conditions.’

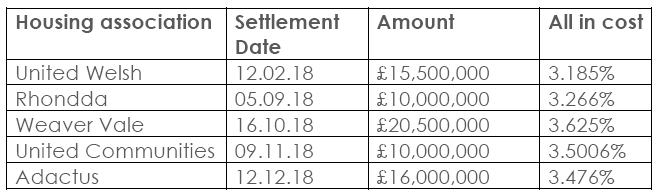

THFC retained bond sales this year

This latest issuance brings total retained bond issuances by THFC to £72m this year.

If you require any further information, please contact:

Piers Williamson, Chief Executive, The Housing Finance Corporation Limited

Tel: 020 7337 9920, Email: Piers.Williamson@thfcorp.com

Paul Chisnell, Executive Director of Finance, Jigsaw Homes Group

Email: Paul.Chisnell@jigsawhomes.org.uk

Related Articles

News

THFC Group companies secure loans for borrowers despite volatile October.

At the beginning of the month THFC sold £13.5million of retained bonds issued by THFC (Funding No. 3) due 2043.

2019-10-29

News

The Housing Finance Corporation (THFC) has made a donation to More than Homes, the UK housing sector’s campaign to raise £1m for the Trussell Trust

THFC donates £7,200 to the More than Homes initiative.

2023-12-04