AHF tap tests new low yield target for Housing Association bonds.

2015-01-01

What is the absolute lowest yield for long term Housing Association (HA) fixed rate Bonds? That has been a recurrent question as so far this year with two HAs: Paragon (3.63%) and Swan (3.63%) so far breaching the psychological 4% barrier with public bond deals.

However, THFC, through its ‘AAA’ rated, AHF, Government guaranteed subsidiary has already delivered over £400m of long term (28 year) funding in the last year at an average interest rate of 3.54%. To cap that achievement AHF today issued a further £194m of bonds at a margin of 0.32% and an all in cost of 2.92% making it by some degree the lowest cost public debt issued on behalf of HAs in the last 27 years and the first to break the 3.0% barrier. “It’s the financier’s equivalent of breaking the four minute mile” said Piers Williamson, Chief Executive of AHF “We had already achieved this for a small number of EIB forward start loans, but this is the first time institutional investors have bought at these levels from us”.

With £600m of bonds now outstanding, AHF’s long bond is the largest deal relating to HAs in the Sterling Capital markets and is believed to be the third largest ‘AAA’ £ Sub-Sovereign bond outstanding, behind two bonds issued by the European Investment Bank (EIB). Williamson added: “while HAs still issue own-name deals they will pay a premium to do so, especially if they are deemed ‘sub-scale’ by investors. In practice, that premium is currently proving to be almost 1% per annum”.

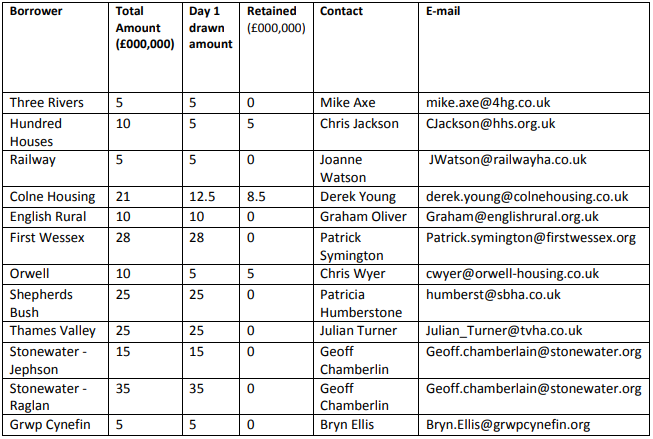

This AHF tap is for 12 underlying HAs. Each has undergone the rigorous credit appraisal process deemed necessary for issuing of a ‘full faith’ long term Government guarantee. The HAs include one Welsh participant and the affordable housing being funded by all participants is located in diverse areas stretching from Rhyl to West London.

Put together with earlier AHF EIB funding, the Affordable Housing Guarantee Scheme has now underwritten credit approvals totalling £1.25Bn for 35 borrowers. Commenting on the success of the scheme so far and the very low rates achieved, Williamson said “we are really delighted with this record low cost of borrowing and HAs are now responding enthusiastically to the AHF offer. With the underwriting period for new guaranteed loans extending to March 2016, we expect a really hectic 12 months bringing more HAs to market”

Housing Minister Brandon Lewis said “since 2010 a key part of our long-term economic plan has been to get the country building again, and restore confidence to the housing market that was so damaged by the 2008 crash.

Thanks to our strong economic record, today’s bond offers the lowest rate of interest to housing associations for some 27 years, and will help deliver thousands of new affordable homes on top of nearly 217,000 new affordable homes we’ve delivered since 2010.”

AHF Contacts

Piers Williamson Chief Executive piers.williamson@thfcorp.com 020 7337 9930

Fenella Edge Group Treasurer Fenella.edge@thfcorp.com 020 7337 9923

Related Articles

News

National Wealth Fund and The Housing Finance Corporation launch new unsecured debt facility for social housing retrofit

National Wealth Fund and The Housing Finance Corporation launch new unsecured debt facility for social housing retrofit with £150m commitment.

2025-02-28

News

EIB II Facility funds further development

The Government guaranteed aggregator Affordable Housing Finance (AHF) has agreed further sub 2% 30-year amortising loans from its £1bn EIB.

2017-09-13