AHF bond Issuance breaks £1Bn barrier

2016-03-09

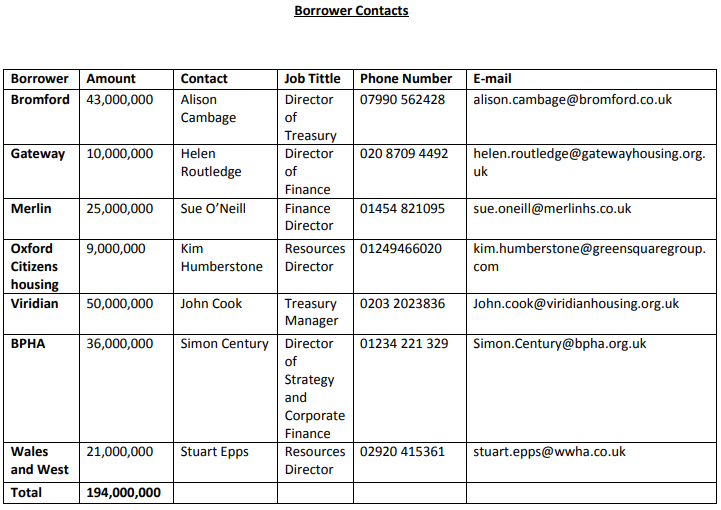

Having completed a new £208m bond at the beginning of August 2015, the Government guaranteed aggregator Affordable Housing Finance (AHF) has followed this up with a significant tap transaction for seven Housing Associations. The £194m transaction, priced at Gilts plus 0.43% and an overall cost of 2.71% represents the lowest cost bulk issuance under the programme to date.

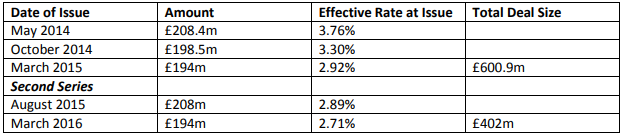

This transaction brings bond issuance under the programme to over a £1Bn for the first time:

AHF Public Bond Issuance History

According to Gareth Francis, Deputy Treasurer of AHF: “Credit spreads under the programme have widened very slightly to 0.43% from recent levels of 0.40%. This reflects the reticence of Sterling investors to put significant amounts of funds to work at the current very low levels of Gilt yields. They are also beginning to focus on the potential uncertainties and market volatility associated with the Europe referendum “. Demand for the transaction was said to be very good with orders from at least one overseas Central Bank augmenting the more typical UK fund management and insurance buyers.

Piers Williamson, Chief Executive of THFC and AHF said “passing the £1Bn bond barrier is a real statement of the success of the Affordable Homes Guarantee Programme. When we add the total of £1.5Bn of potential investment by the European Investment Bank in the programme, you can see what we have been able to achieve under the programme as a whole during its three year life. The very low cost of funding has helped deliver a very significant number of badly needed affordable homes”. AHF estimate by the close of the programme that circa 29,000 affordable homes will have been financed under the scheme.

Related Articles

News

Are mergers effective, or do they just perpetuate bad practice?

HA governance structures are unsuited to M&A When RBS bought ABN at the wrong time and for the wrong price.

2017-10-06

News

THFC announces Appointment of Chairman Designate

Following an extensive search process, The Housing Finance Corporation (THFC) today announced the appointment of Ian Peacock as its chairman.

2013-01-04