AHF Bond breaks £1Bn issuance barrier

2017-03-28

Affordable Housing Finance (AHF) priced an £88m tap of its second long-term bond today to bring the outstanding under the bond to over £1Bn for the first time. Priced at Gilts plus 0.28%, the reoffered cost of the bond, at 2.06% was comfortably below the 2.24% cost of its previous January 2017 tap. In the intervening two months, long term Gilt spreads have been volatile, moving through a 0.4% range in February alone, reflecting current geo-political and economic uncertainty.

“it’s perhaps not surprising that some HAs want to lock in at these absolute levels” said Piers Williamson, THFC Group Chief Executive “in meeting the Government’s policy goal of delivering badly needed affordable homes, they want as much certainty as possible in managing their cost bases.”

Commenting on the tight spread of the deal, Williamson added “It’s not quite that we have left the best until last, but investors remain keen to scoop up bonds in the primary market whenever they are available. We are into the tail end of the AHF programme, but we still have some retained bonds and potentially another deal to do later this year and then that will be it”.

The official close for new applications for participation in the Affordable Housing Guarantee Scheme (AHGS) was March 2016. Since then, AHF have been working through the large pipeline of eligible borrowers.

AHF estimate that by summer 2017 it will have lent in excess of £3Bn under the AHGS (out of an available £3.5Bn) and split around 50/50 between long term institutional finance from the Sterling bond market and long-term lending from the European Investment Bank. AHF successfully sourced a £1Bn line of credit from EIB just prior to last summer’s BREXIT referendum and believe that they will successfully place the bulk of this facility prior to the end of its availability period later in 2017.

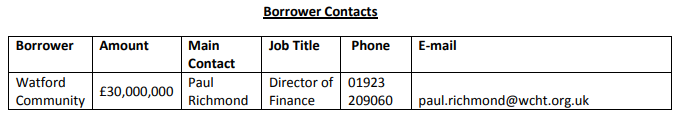

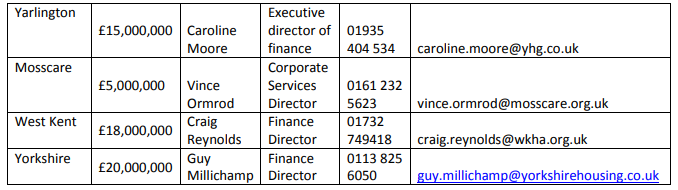

Taking part in this tap transaction were five Housing Associations representing very different local housing markets. Of particular note was a £5m participation for Mosscare, a leading regeneration specialist in South and East Manchester (currently in merger discussions with another Manchester HA: St Vincents).

Contacts:

AHF: Piers Williamson, Chief Executive: piers.williamson@thfcorp.com

Tel: 020 7337 9930 or 07932 701430

Related Articles

News

Statement from THFC on Covid-19

In light of recent events, The Housing Finance Corporation would like to reassure borrowers and investors that there will be.

2020-03-18

News

THFC announces new Chief Executive

The Housing Finance Corporation (THFC), the UK’s leading affordable housing aggregator, has announced the appointment of Priya Nair as its.

2024-01-30