© Newlon

How we operate

The Housing Finance Corporation (THFC) is the UK’s leading affordable housing aggregator. Set up in 1987, THFC issues long-term bonds in the Sterling capital markets and on-lends the proceeds to housing associations.

© Anchor Hanover

Throughout its history THFC has demonstrated its commitment to the social purpose of housing associations by innovating new products to achieve the best possible terms of funding, allowing its 160+ HA borrowers to grow and meet the demand for affordable housing. As a not-for-profit, the Group’s surpluses are retained and reinvested to ensure THFC can continue to provide competitively priced funding for HAs long into the future.

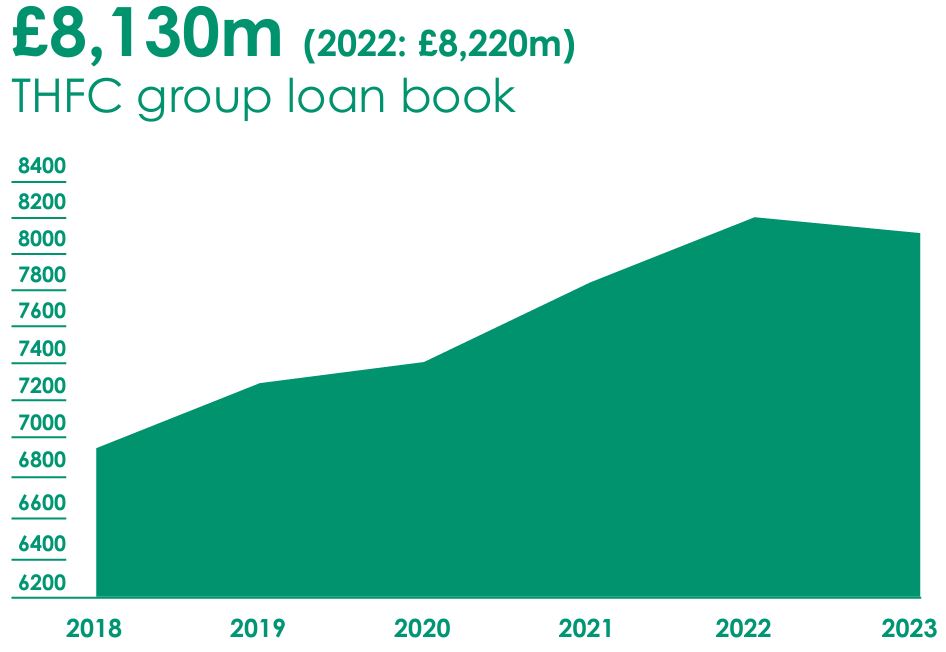

By serving the affordable housing sector in this way THFC has become a trusted name and achieved steady growth. Its Group loan book now totals over £8bn and it has a dedicated and experienced team, allowing it to offer a comprehensive in-house service.

The THFC model allows investors to diversify risk through THFC as an aggregating financial intermediary, and housing associations to get long-term, low-cost funding on standardised terms.

© New Gorbals

© Jigsaw

© A2 Dominion

For Borrowers

THFC loans to borrowers from across the country, big and small. See how we can help you access low-cost funding.