THFC Funding 3 Tap creates largest housing bond

2012-09-20

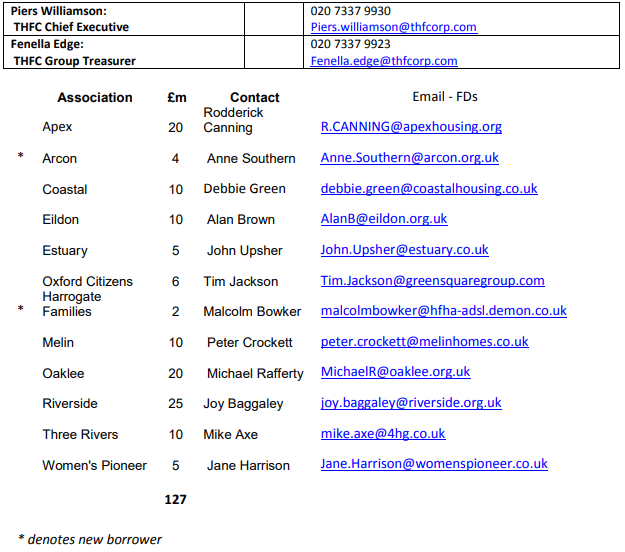

THFC priced the third tap of its 31 year bond today at 4.99%. The £127m tap issue brings the total outstanding on THFC Funding 3 to £488.6m. The next largest single deal is Circle Anglia at £385m.

The deal comes hot on the heels of two private placements for the sector, for Midland Heart and Raglan Housing Associations and priced inside both. “While the Midland Heart and Raglan transactions represented good value and were a step change from the pricing of some earlier deals, the demand and execution of this deal shows that public bond deals can still offer the most competitive terms” said Piers Williamson, Chief Executive of THFC. He added: “In the last 10 years there have only been nine long term public deals done under 5%, and THFC has completed 4 of them”.

Market tone has been good with institutional investors viewing HA bonds as delivering value for the pension and annuity funds they manage. There were 21 investors in the THFC issue, including 4 new investors. The book was nearly four times oversubscribed despite price guidance being tightened to well within 2% over Gilts (The31 year non-amortising deal priced at 1.88% over Gilts).

The deal marks the first of a probable number of HA Bonds over the Autumn months, ahead of the expected announcement of more details on Government Guarantees, slated for the Chancellor’s Autumn Financial Statement on December 4.

There were a total of 12 Housing Association participants in THFC’s deal. Amongst them was Riverside Housing Group. Joy Baggaley Group Deputy Chief Executive and Finance Director of Riverside said the attractions of participating in the tap were twofold.

“THFC funding represents a time and cost efficient way to raise long term finance and in particular the flexibility to redistribute security already in charge to THFC allowed Riverside to extract the maximum benefit from those assets.”

THFC’s latest deal brings overall HA public bond issuance to nearly £2.7Bn so far this year.

Contacts

Related Articles

News

West Kent secures new £50m funding deal to build more affordable homes across Kent in years to come

West Kent secures new £50m funding deal to build more affordable homes across Kent in years to come The £50m.

2023-07-20

News

THFC welcomes George Blunden as its new Chairman of the board

The Housing Finance Corporation (THFC) today announced the appointment of George Blunden as its Chairman designate. George joined the board.

2019-04-11