AHF Breaks 2% barrier again

2016-07-11

Affordable Housing Finance (AHF), the Government guaranteed aggregator issued a further £124.5m of long term bonds today, narrowly bettering its own record for the lowest primary issuance rate, pricing at a re-offered yield of 1.983% (Gilts plus 0.36%). The transaction included the issuance of a further £24m of retained bonds.

Despite short term volatility in the capital markets, associated with BREXIT and currency concerns, the deal met with broad appeal amongst investors, which included one overseas Central Bank.

“With the fanfare in the markets for the Bank of England’s £10Bn Corporate Bond Purchase Programme (CBPP), it is slightly ironic that overseas Central Banks are buying our bonds before our own Central Bank” said Piers Williamson, AHF Chief Executive. “The Bank of England’s absence hasn’t changed the appeal of our deal, but you would have thought that the efficient funding ofbadly needed affordable homes fitted their mandate”. To date no Housing Association’s bonds have been included in the programme. AHF’s second bond now has an aggregate principal outstanding of £848.4m, making it one of the larger long term Sterling bonds, for any type of borrower, in issuance.

Advisers suggest that inclusion of HA Bonds in the CBPP would have the effect of tightening credit spreads and would add to the efficiency of bond funding as a long term source of capital for HAs.

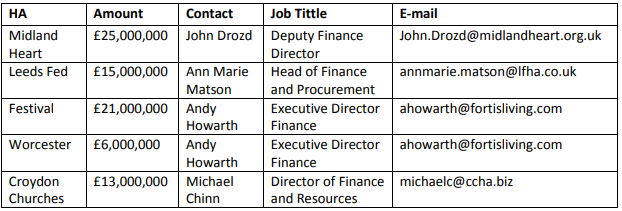

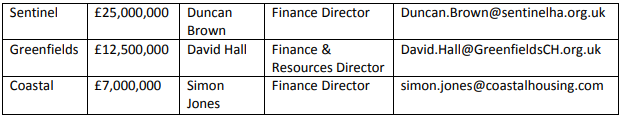

The funding was for a broad range of Housing Associations, including at one end of the spectrum the 33,000 unit Midland Heart and at the other end, the community based Croydon Churches HA which owns and manages nearly 1,500 homes. AHF does not distinguish between the pricing of different sized HAs (so called risk-based pricing) meaning that very different types of HAs can benefit from accessing the Government Guarantee in return for delivering more affordable housing. To date some 54 borrower groups have accessed the programme which according to Mr Williamson, by its close, may have lent approaching £3Bn.

Contacts:

AHF: Piers Williamson, Chief Executive: piers.williamson@thfcorp.com

Tel: 020 7337 9930

Related Articles

News

THFC Bond Issue reaches £1Bn milestone

Today, THFC Funding no. 3 passed the important £1bn threshold of issuance with its 8th tap issue, five years after.

2019-01-18

News

AHF price £49.5m of retained bonds for five housing associations

The Government guaranteed aggregator, Affordable Housing Finance (AHF), has sold the remainder of its outstanding retained bonds in two transactions..

2017-12-11